AEGIS

PROTECTIVE

SERVICES

PROTECT YOURSELF

IDENTITY THEFT

THE OVERVIEW

Tips to avoid becoming a victim of Identity Theft and Credit Card Fraud.

Identity theft and credit card fraud is a huge and growing problem. According

to the Privacy Rights Clearinghouse, it claims half

a million victims annually and costs financial institutions

more than $5 billion. Worse, the crimes themselves

are becoming more sophisticated.

Identity theft and credit card fraud is a huge and growing problem. According

to the Privacy Rights Clearinghouse, it claims half

a million victims annually and costs financial institutions

more than $5 billion. Worse, the crimes themselves

are becoming more sophisticated.

If it happens to you, you're basically on your own, although six identity-theft bills have been introduced in Congress, and Federal Trade Commissioner Timothy J. Muris says, "We're taking steps to make it easier for people who have been victims of identity theft to rehabilitate themselves."

The bottom line: In identity theft, as in football, your best offense is a good defense. Don't give out your Social Security number unless absolutely necessary. Don't print more than your name and address on your checks. Never give information on the phone to someone who has called you. And take the following precautions.

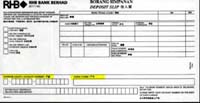

Guard your deposit slips.

I'll never write a shopping list

on a deposit slip again. Why? A crook could drive

up to my bank, use one of his own checks to write

a worthless check to my account, deposit it and--using

the "less cash received" line on the slip--pull out

$100. (Most banks will check ID for more than that.)

That's check fraud, so I wouldn't be held liable,

but I'd have to go through the hassle of filing an

affidavit to get my money back. Or, even worse, the

thief could use the slip to get himself a supply of

my checks.

I'll never write a shopping list

on a deposit slip again. Why? A crook could drive

up to my bank, use one of his own checks to write

a worthless check to my account, deposit it and--using

the "less cash received" line on the slip--pull out

$100. (Most banks will check ID for more than that.)

That's check fraud, so I wouldn't be held liable,

but I'd have to go through the hassle of filing an

affidavit to get my money back. Or, even worse, the

thief could use the slip to get himself a supply of

my checks.

Watch the mail.

Tear up all pre-approved credit solicitations and pay attention to billing cycles. If a credit-card bill is more than a few days late, call the issuer and ask if there have been any inquiries or changes to your account.

Watch your back.

I'm serious. The next time you're writing a check in the grocery store, ask yourself how long it would take a thief to memorize the name, address and phone number on your check, and the number on your driver's license (which just may be your Social Security number). Abagnale's estimate: eight seconds.

Be

suspicious.

Be

suspicious.

Years ago when someone picked your pocket, they took the cash and threw the wallet in the trash. Today they look for a business card, head to a phone, call you and say, "I just found your wallet. I'll send it back." You're relieved -- and they get two more days to use your credit cards.

While we do what we can, let's encourage creditors to do their part. How? By doing a better job of checking the basic information on credit applications. A change of address could easily be a giveaway for fraud.

*Article provided by the CNN MONEY Click on the link or banner to be connected to the official website of CNN MONEY

AEGIS

PROTECTIVE

SERVICES

PROTECT YOURSELF

IDENTITY THEFT

|

Home

PORTFOLIO

Contacts

Employment

Services Training FAQS Resources About US |